Book value represents the financial strength of a company based on its assets, an objective number. In contrast, market value represents the attractiveness of a company's share in the marketplace, a somewhat more subjective number. The real advantage for investors lies in comparing these values to one another for a specific company. Book Value, as the name signifies, is the value of the commercial instrument or asset, as entered in the financial books of the firm.

Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. If you are not currently resident of Canada, you should not access the information available on the RBC Direct Investing website. The information provided in this article is for general purposes only and does not constitute personal financial advice. Please consult with your own professional advisor to discuss your specific financial and tax needs. Along the way, the book value of Anne’s investment changed when she made an additional contribution ($100) and again when she reinvested the distribution ($50).

It does not consider intangible assets such as patents, intellectual property, brand value, and goodwill. Moreover, it doesn’t account for how a firm’s assets will generate profits and growth over time. Therefore, the market value, which takes into consideration all of these things, will generally be higher. Consider technology giant Microsoft Corp.’s (MSFT) balance sheet for the fiscal year ending June 2020. It reported total assets of around $301 billion and total liabilities of about $183 billion. That leads to a book valuation of $118 billion ($301 billion - $183 billion).

Price-to-Book (P/B) Ratio

Buyers and sellers don't always agree on a value of a product, and each side has different goals, with buyers hoping to pay less and sellers hoping to charge more. Market value provides a fair estimation of the value or worth of any given asset. However, after two negative gross domestic product (GDP) rates, the market experiences a significant downturn.

The market value is the value of a company according to the financial markets. The market value of a company is calculated by multiplying the current stock price by the number of outstanding shares that are trading in the market. Both book and market values offer meaningful insights into a company's valuation.

For example, the market value of a publicly-traded company may fluctuate every second due to the fluctuations in its stock price. Investors should use book value and market value in tandem when making investment decisions. An investor needs to understand the rationale behind the numbers to make an educated stock pick. When book value equals market value, the market sees no compelling reason to believe the company's assets are better or worse than what is stated on the balance sheet. There are end number of factors can influence the market value of a company like profitability, performance, liquidity or even a simple news can increase or decrease its market value. J.B. Maverick is an active trader, commodity futures broker, and stock market analyst 17+ years of experience, in addition to 10+ years of experience as a finance writer and book editor.

She subsequently invests an additional $100 and has set up her account to have any distributions reinvested. Market value is affected by factors like what industry the firm or asset belongs to, its overall profitability, and how much debt it's taken on, among other factors. Here are some limitations of using market value as a guide for when to invest in an asset.

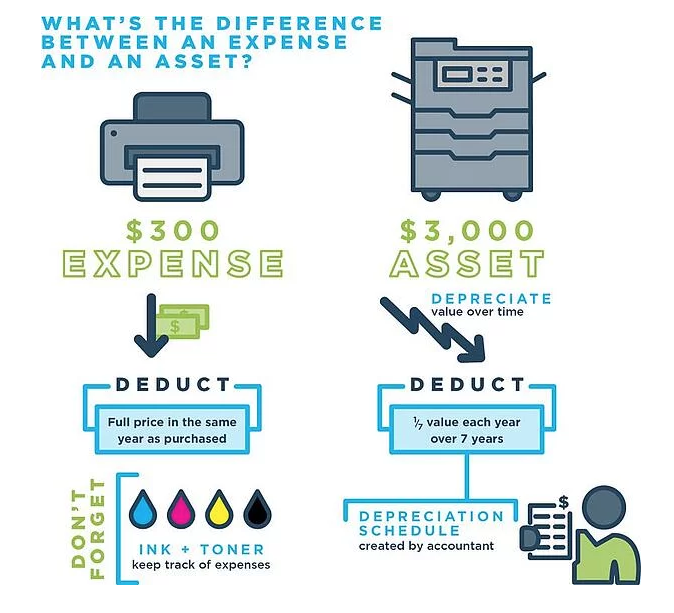

When you sell your investments in a non-registered account, book value is used to determine your capital gain or capital loss for tax purposes. Book value is equal to the cost of carrying an asset on a company’s balance sheet, and firms calculate it by netting the asset against its accumulated depreciation. As a result, book value can also be thought of as the net asset value (NAV) of a company, calculated as its total assets minus intangible assets (patents, goodwill) and liabilities. All other things being equal, a higher book value is better, but it is essential to consider several other factors. People who have already invested in a successful company can realistically expect its book valuation to increase during most years.

What is market value?

Market value, also called fair value, is what an asset would sell for in the current market. The market value of an asset is usually different than its book value, depending on whether the asset is increasing or decreasing in value. When you purchase an asset, you must record it at its book value in your small business accounting books. Book value gets its name from accounting lingo where the balance sheet is known as a company’s “books.” In fact, accounting was once called bookkeeping.

These differences usually aren't examined until assets are appraised or sold to help determine if they're undervalued or overvalued. A market-to-book ratio above 1 means that the company’s stock is overvalued. A ratio below 1 indicates that it may be undervalued; the reverse is the case for the book-to-market ratio. Analysts can use either ratio to run a comparison on the book and market value of a firm. One case in which a business can recognize changes in the value of assets is for marketable securities classified as trading securities.

Book Value: Definition, Meaning, Formula, and Examples

Ultimately, accountants must come up with a way of consistently valuing intangibles to keep book value up to date. Investors can find a company's financial information in quarterly and annual reports on its investor relations page. However, it is often easier to get the information by going to a ticker, such as AAPL, and scrolling down to the fundamental data section.

- This means that, in the worst-case scenario of bankruptcy, the company's assets will be sold off and the investor will still make a profit.

- In other words, the fair value of an asset is the amount paid in a transaction between participants if it's sold in the open market.

- The book-to-market ratio is used to compare a company’s net asset value or book value to its current or market value.

- Therefore, creditors use book value to determine how much capital to lend to the company since assets make good collateral.

Carrying value is typically determined by taking the original cost of the asset, less depreciation. Critics of book value are quick to point out that finding genuine book value plays has become difficult in the heavily-analyzed U.S. stock market. Oddly enough, this has been a constant refrain heard since the 1950s, yet value investors continue to find book value plays. Failing bankruptcy, other investors would ideally see that the book value was worth more than the stock and also buy in, pushing the price up to match the book value. Some assets might have a higher market value than book value, meaning it would sell for more than what you paid for it minus depreciation. The amount of money you put into your company may outweigh its worth in the current market.

This would be a good time to sell the stock or avoid buying it as most likely there will be a market correction, causing the share price to drop. The book value of an asset refers to its cost minus depreciation over time. The fair value of an asset reflects its market price; the price agreed upon between a buyer and seller. The need for book value also arises when it comes to generally accepted accounting principles (GAAP). According to these rules, hard assets (like buildings and equipment) listed on a company's balance sheet can only be stated according to book value. This sometimes creates problems for companies with assets that have greatly appreciated; these assets cannot be re-priced and added to the overall value of the company.

However, because it can be so subjective, it's important for investors to decide for themselves which metrics are most important in their own evaluation of an investment. Market value is also more significantly influenced by market perception than market capitalization. Rebell says that because market value has so many subjective components, it has a lot in common with market perception. Market value is a term often used interchangeably with market capitalization, but wrongfully so.

Market Value vs Book Value

It then subtracts intangible assets (copyrights, patents, intellectual property) and liabilities (like loans, taxes, and other debts). While the book value of an asset may stay the same over time by accounting measurements, the book value of a company collectively can grow from the accumulation of earnings generated through asset use. So if the book value of a company is higher than Book Value Vs. Market Value its market value, it means that investors are not factoring in its actual financial fundamentals — the strength of its operations and balance sheet. Market value is also known as market capitalization, is the value of all of a company's stock in the marketplace. It's what it would cost you if you were to buy up every one of its outstanding shares at the current share price.

The ratio determines the market value of a company relative to its actual worth. Investors and analysts use this comparison ratio to differentiate between the true value of a publicly-traded company and investor speculation. Book value is the accounting value of the company’s assets less all claims senior to common equity (such as the company’s liabilities).

Profitable companies typically have market values greater than book values. Most of the companies in the top indexes meet this standard, as seen from the examples of Microsoft and Walmart mentioned above. However, it may also indicate overvalued or overbought stocks trading at high prices. Value investors actively seek out companies with their market values below their book valuations. They see it as a sign of undervaluation and hope market perceptions turn out to be incorrect.

In personal finance, the book value of an investment is the price paid for a security or debt investment. When a company sells stock, the selling price minus the book value is the capital gain or loss from the investment. For example, a company buys a machine for $100,000 and subsequently records depreciation of $20,000 for that machine, resulting in a net book value of $80,000.